Modern Stablecoins: The Digital Parallel

Introduction

Have you ever looked at a dollar bill and wondered about its history? That green piece of paper in your wallet is the product of centuries of monetary evolution. But what is even more fascinating is how today's cutting-edge financial technology - stablecoins - bears striking resemblances to a monetary system from over 150 years ago.

A Brief History Lesson: The National Banking Era

Before we dive into stablecoins, let's take a quick trip back to 1863. The United States was in the midst of the Civil War, and its monetary system was, to put it mildly, a mess.

Prior to this period, America experienced what economists call the "Free Banking Era" - a chaotic time when hundreds of state-chartered banks issued their own unique banknotes. Imagine walking into a store with a $5 note from your local bank, only to have the shopkeeper scrutinize it suspiciously, wondering if it was counterfeit or if the issuing bank had failed overnight. Exchange rates between different banks' notes fluctuated wildly, and counterfeiting was rampant.

To address this chaos, Congress passed the National Banking Act of 1863, which was significantly strengthened by the National Banking Act of 1864. These acts created a framework where:

- Nationally chartered banks could issue standardized currency

- These notes were backed by U.S. government bonds held as collateral

- A new federal regulator, the Office of the Comptroller of the Currency, oversaw operations

- The notes were uniform in design (as specified by the federal government)

- The government fully insured these notes if the issuing bank failed

The system was further solidified by the 1866 amendment that imposed a 10% tax on state banknotes, effectively pushing them out of circulation and cementing the national banking system's dominance.

The Golden Age of American Growth

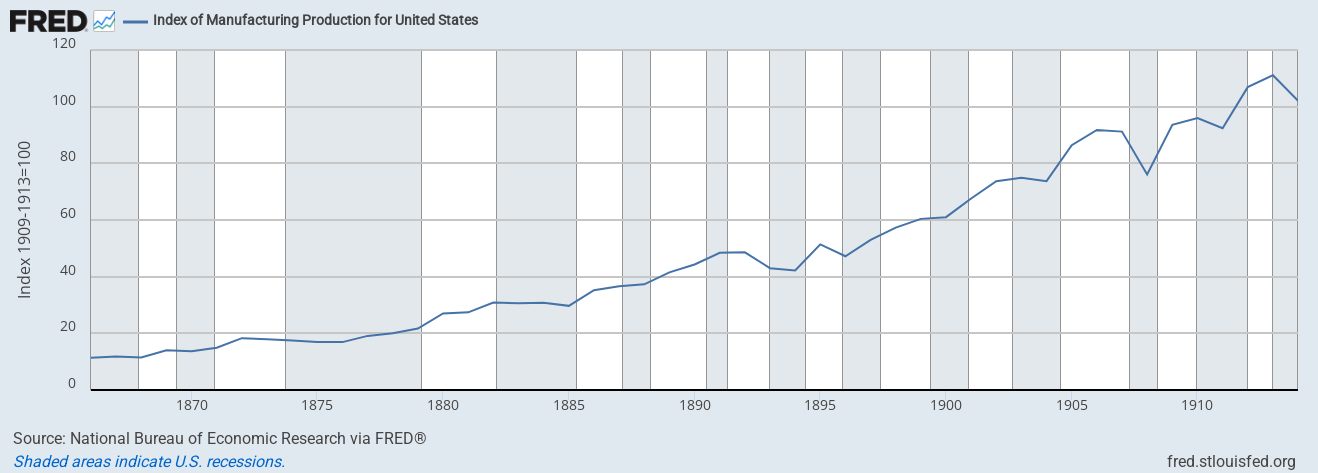

What followed this monetary standardization was nothing short of remarkable. The period from 1866 to 1913 - the heart of the National Banking Era - coincided with what many economic historians consider the fastest period of economic growth and increasing prosperity in American history.

During these decades:

- The transcontinental railroad was completed

- American steel production grew from negligible to world-leading

- Electrification transformed cities and manufacturing

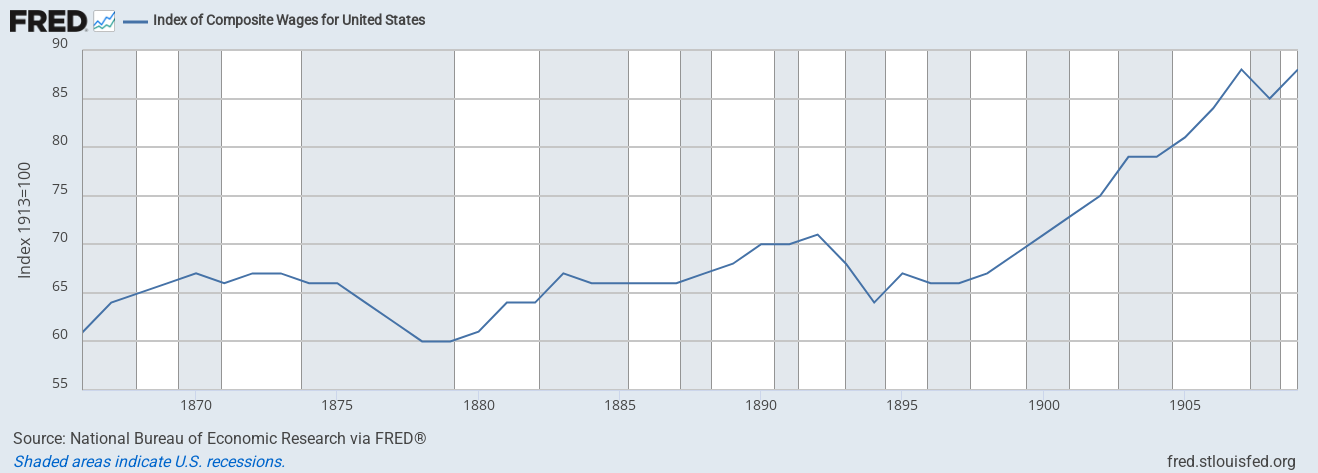

- Real wages rose substantially across income levels

- The U.S. transformed from a primarily agricultural economy to an industrial powerhouse

Perhaps most notably, this era saw a more equitable distribution of the economic gains than many other periods of American history. While the "Gilded Age" certainly had its robber barons and inequality, the rising tide of industrialization and standardized currency lifted many boats, with real wages for ordinary workers growing substantially.

The stable, uniform currency system played a crucial role in this economic transformation by facilitating commerce, enabling investment, and creating confidence in the financial system. It wasn't perfect - the era still experienced financial panics in 1873, 1893, and 1907 - but the standardized currency provided a foundation for unprecedented growth.

Stablecoins: Digital Descendants of National Banknotes

Fast forward to today. While Bitcoin and other cryptocurrencies have captured headlines with their wild price swings, a quieter revolution has been brewing: stablecoins.

Stablecoins are cryptocurrencies designed to maintain a stable value, typically by pegging to a fiat currency like the U.S. dollar. And here's where history gets interesting - their design philosophy bears remarkable similarities to those national banknotes from the 1800s.

The Parallels Are Striking

Asset-Backed Design

Just as national banknotes were backed by government bonds held in reserve, today's leading stablecoins like USDC and USDT (Tether) are backed by reserves of dollars or other assets. This creates a similar "redemption guarantee" structure - you can (theoretically) exchange your stablecoin for the underlying asset at any time.

Private Issuance with Public Connection

Both systems involve privately issued currency with a direct connection to government-backed assets. National banks issued banknotes backed by U.S. bonds; stablecoin issuers create tokens backed by U.S. dollars or Treasury bills.

Standardization Within Systems

While different stablecoin issuers exist (Circle, Tether, etc.), coins within each system maintain uniform value and design. This mirrors how national banknotes had standardized designs despite being issued by different banks across the country.

Trust Through Transparency

The National Banking System built trust through federal oversight and transparent backing requirements. Similarly, the most successful stablecoin projects are increasingly embracing transparency through regular attestations and audits of their reserves.

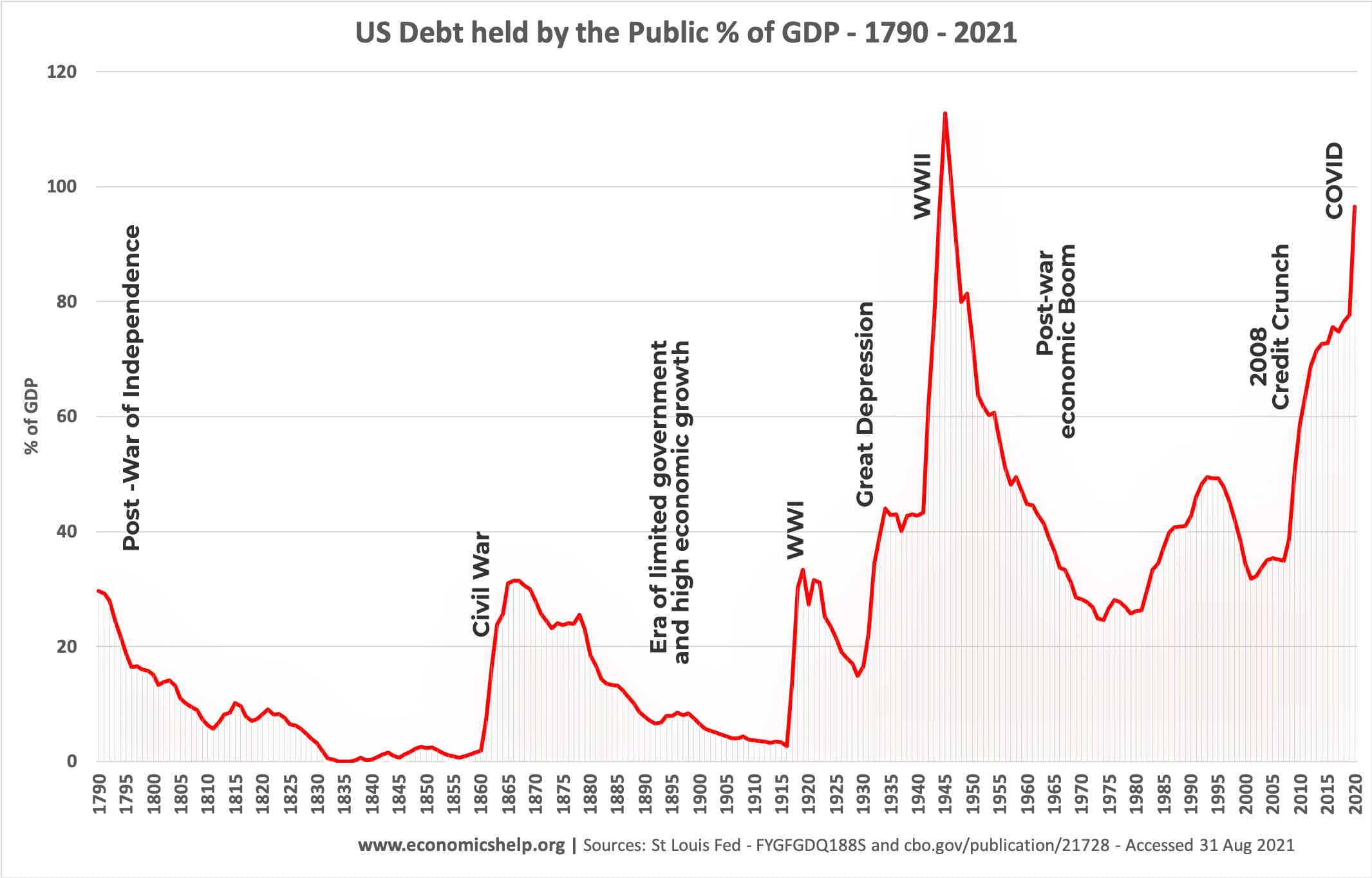

Financing National Debt

The National Banking System was instrumental in financing the Civil War debt. Each national bank was required to hold U.S. government bonds as collateral for the banknotes they issued. This requirement not only stabilized the currency but also provided a ready market for government bonds, helping the United States finance its war effort and subsequent reconstruction. The bond requirement ensured that banks had a vested interest in the government's financial stability, creating a unique public-private partnership that helped the nation recover from the war's financial toll.

Learning From History

The National Banking Era was not perfect, but it successfully addressed many of the problems of the chaotic Free Banking Era and helped fuel America's economic transformation. Similarly, stablecoins are attempting to solve cryptocurrency's volatility problem while preserving its benefits of programmability and global accessibility.

Could stablecoins help unlock a similar period of economic growth and innovation? The historical parallel suggests they might - if properly designed and regulated.

The National Banking System eventually gave way to the Federal Reserve System in 1913, centralizing currency issuance under government control. Will stablecoins follow a similar path, eventually being replaced by Central Bank Digital Currencies (CBDCs)?

The historical record suggests that some level of government involvement is often necessary for a stable monetary framework. The question is not whether regulation will come to stablecoins, but what form it will take.

The Road Ahead

As regulators worldwide grapple with how to approach stablecoins, they might find valuable lessons in the National Banking Era:

- Clear backing requirements created confidence in national banknotes

- Standardization improved usability and reduced fraud

- Oversight balanced innovation with stability

- Coexistence with government money proved possible for decades

- Economic growth followed monetary stability

For users of stablecoins, understanding this historical parallel offers perspective. We're not witnessing something entirely new, but rather a digital evolution of monetary concepts that have deep historical roots.

The next time you send USDC to a friend or hold USDT in your digital wallet, remember that you're participating in a modern version of a financial system that helped build America's economy over 150 years ago. The technology is new, but the fundamental concepts - trust, backing, and standardization - are time-tested principles of sound money.

In our rapidly evolving financial landscape, sometimes the best way forward is to understand where we've been. The rhymes of monetary history are playing out before our eyes, now in digital form.

What do you think?

What do you think about the parallels between stablecoins and historical banking systems? Have you used stablecoins in your daily life? Share your thoughts in the comments below!

References

- Friedman, Milton, and Anna Jacobson Schwartz. A Monetary History of the United States, 1867-1960. Princeton University Press, 1963. This seminal work provides comprehensive analysis of the National Banking Era, including the impacts of the 1864 and 1866 Acts on currency standardization and economic growth.

- White, Eugene N. "The Regulation and Reform of the American Banking System, 1900-1929." Princeton University Press, 1983. Offers detailed insights into how the national banking system functioned and its role in American economic development.

- Gordon, Robert J. The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War. Princeton University Press, 2016. Documents the extraordinary period of economic growth from 1870 to 1940, with particular attention to the National Banking Era's contribution to industrial expansion.

- Calomiris, Charles W., and Stephen H. Haber. Fragile by Design: The Political Origins of Banking Crises and Scarce Credit. Princeton University Press, 2014. Provides context on how the National Banking System's design influenced financial stability and economic development.

- Federal Reserve Bank of Richmond. "A Historical Perspective on Digital Currencies." Economic Brief, July 2022. Draws explicit parallels between historical private currencies (including National Bank notes) and modern digital currencies, including stablecoins.

Chart Sources

- Industrial Production Growth Chart: Federal Reserve Economic Data (FRED), Historical Manufacturing Production Index (A0107AUSA322NNBR), https://fred.stlouisfed.org/series/A0107AUSA322NNBR

- Data Source: National Bureau of Economic Research (NBER)

- Series Description: Index of Manufacturing Production for United States, Monthly, Not Seasonally Adjusted

- Time Period: 1863-1930

- Real Wages Growth Chart: Federal Reserve Economic Data (FRED), Index of Composite Wages (A0861AUSA324NNBR), https://fred.stlouisfed.org/series/A0861AUSA324NNBR

- Data Source: National Bureau of Economic Research (NBER)

- Series Description: Index of Composite Wages, Monthly, Not Seasonally Adjusted

- Time Period: 1860-1948

- U.S. Debt-to-GDP Ratio Chart: Economics Help, "U.S. debt held by public from 1790-2021," https://www.economicshelp.org/blog/10772/economics/us-debt-historical/

About the Author

Victor Cook, Ph.D. is a financial history enthusiast and CEO of Ethpar.com