About ETHPAR

Ethereum L1 Fork Optimized for Stablecoins

Architecture Overview

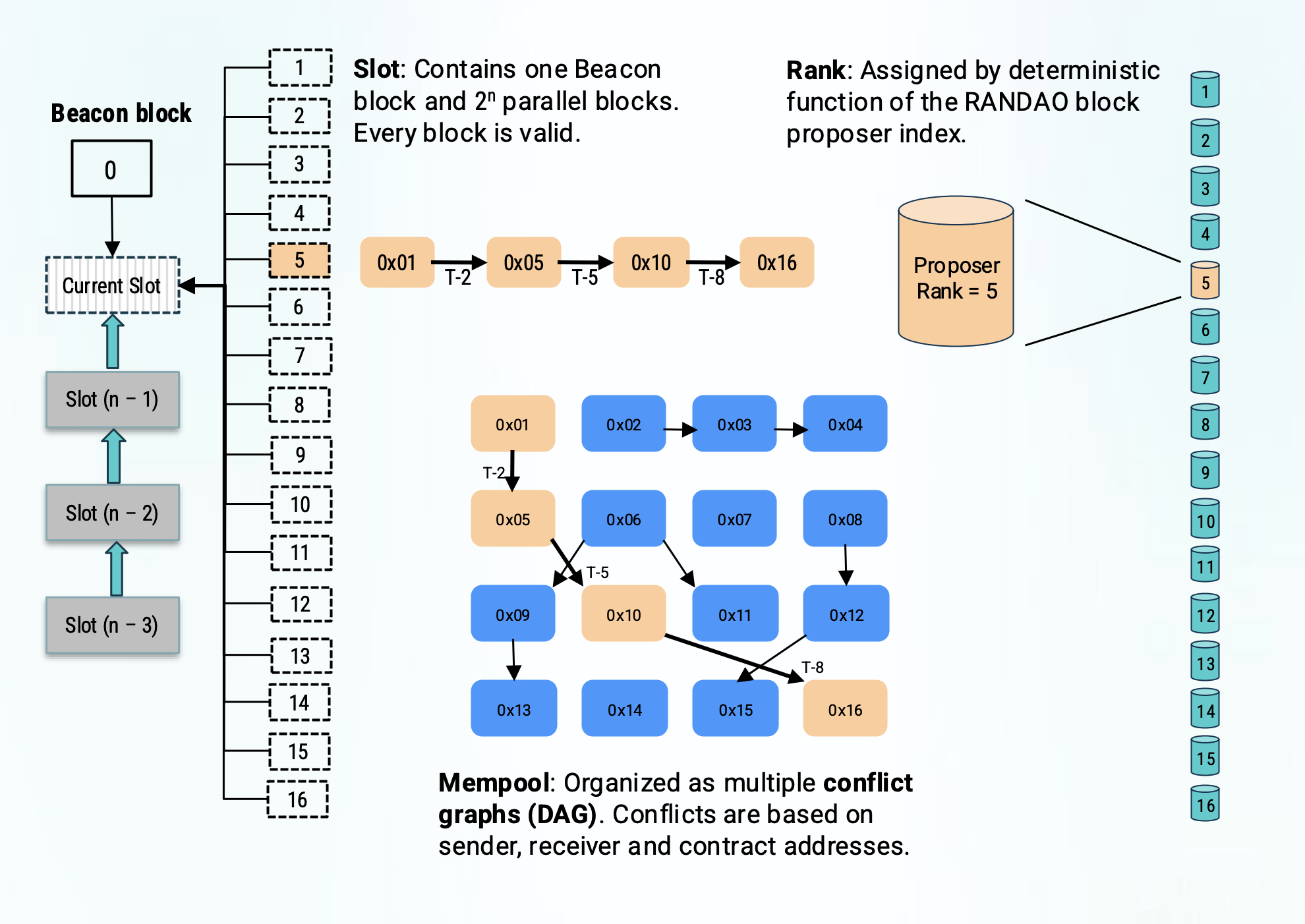

Our architecture is specifically designed for stablecoin transactions, providing node-level isolation, wait-free transactions, and the ability to pay fees in stablecoins themselves.

Core Technology

ETHPAR is an EVM Layer 1 blockchain specifically optimized for stablecoins and retail payments. Built by a team of blockchain PhDs and merchant processing experts, we're targeting the $10T/year US retail payments market with technology designed for merchant processing needs.

While 80% of stablecoins currently exist on just two L1s (Ethereum 50%, TRON 30%), less than 0.1% of stablecoin flow is used for retail payments. Ethpar provides the proper technical foundation to change this.

As a fork of Ethereum Layer 1, Ethpar includes the entire Ethereum history prior to February 17, 2025, making it 100% compatible with existing smart contracts, wallets, and tooling.

Our Mission

ETHPAR is on a mission to create the ideal blockchain infrastructure for stablecoins, targeting the $10T US retail payments market with technology specifically designed for merchant processing.

Led by a team of blockchain PhDs and merchant processing experts including Victor Cook (CEO), Christina Peterson (CTO), and Todd Lawrence (EVP), we've built an Ethereum fork that solves the three critical requirements for stablecoin transactions:

- Node level isolation (node = thread, isolation = DB ACID)

- Guaranteed "wait free" transactions (not dependent on block intervals)

- Ability to pay fees in stablecoin itself (not blockchain tokens)

Our mainnet launched February 17, 2025, with a complete ecosystem including RPC, Explorer, Oracles, Stablecoins, NFT support, and Bridge functionality. With 1,300+ validators already on the network, we're building the foundation for the future of retail payments on blockchain.

Ethpar - Solving Ethereum Issues (Business)

|

Step 1: Admit the Problem |

Step 2: Identify Issues |

Step 3: Find Critical Path |

Step 4: Understand Current State |

Step 5: Ethpar Solution |

|

Customer Experience |

User learning curve is steep. Information is fragmented for onboarding. |

Key pain points:

different rules, liquidity |

Neutrality for the diverse world of non-financial applications, while neglecting the mainstream |

Ethpar promotes development of consumer apps like payments, loans, ramps. |

|

Customer Experience |

Ethereum does not own the customer, lost loyalty and brand value. |

Key pain points:

|

Ethereum is like an insurance company for L2 chains: We call them “Re-Swiss ETH“ |

Ethpar is a technology company with a focus on customers. Our stakers are like ISVs and can earn the fees from their own dApps. |

|

EF Leadership |

Leadership became more political. |

EF leadership was not aligned with builders. Vitalik was a single point of failure. |

EF appointed two new co-directors in 2025. |

Ethpar leadership is aligned with our ecosystem goals, stated here. |

|

ETH Valuation |

ETH valuation does not reflect the primacy of Ethereum and its ecosystem. |

Intangibles, not book assets, are the value in technology. Ethereum has been spending value, not growing value. |

EF leadership has been dismissive of criticism and ETH valuation concerns. |

Long term value accrued to the Ethpar token is the way to reward stakeholders. |

|

EF Incentives |

EF incentives are reversed, pushing talent away from the core. |

Exodus of core talent to L2 and other projects. In 2024, EF made a rule against consulting, further discouraging those not already rich. |

ETH 2021 price is about the same as today. EF talent has moved to more lucrative projects. |

Ethpar tokenomics incentivizes builders with familiar ISV model and core team with stock options. |

|

Throughput |

Gas limits smart contract complexity and transactions per block |

Processor speed, including EVM and concurrent workloads on the client |

Ethereum plans to increase gas limit graduall. Surprise: Vitalik makes the case for Ethpar-like scaling in this post. |

Ethpar today builds many blocks at once on parallel nodes, optimizes concurrent workloads. |

|

Throughput |

Small block size means fewer and smaller transactions per block. |

Cost of high throughput NVMe limits data transfer and storage capacity. Bandwidth not available everywhere. |

Ethereum limits chain size and bandwidth required to permit solo stakers. |

Ethpar solo stakers can run worldstate nodes without sacrificing scalability. |

|

Throughput |

EVM opcodes not efficient, ZK solvers for L2 blobs is a bottleneck |

System architecture is not ideal. Ethereum is “anti-parallel”, with 1,000,000 validators to produce a single block. |

Ethereum plans RISC-V retooling but sadly, not to scale L1, rather to speed ZK solvers for L2. |

Ethpar plans parallel L1 EVM processing and FPGA hardware offload and encoding of smart contracts. |

|

Latency |

Block interval is a long wait (12 seconds). |

It does not take 12 seconds to produce a block. Communication delays are the issue. |

Sophisticated block building with MEV auctions cause delays. |

Multiple proposers build blocks independently using |

|

Latency |

Finality takes an eternity. |

Communication and coordination of a million validators is the limiting factor in epoch finality. |

Ethereum talks about slot level finality but mostly pushes users to L2. |

Finality can be achieved dynamically with a mempool DAG, smart contract business rules and order flow. |

|

MEV |

MEV is a problem. |

MEV skims value created by dApps and causes customers to lose trust. Technical solutions exist, but there is little desire to implement them. |

Ethereum staking return is so low as to be unattractive without MEV-boost. MEV results in centralized block building. |

Multiple block proposers on Ethpar limit most MEV. Contract specific validators can enforce their own sequencing rules. |

Join the Stablecoin Revolution

Be part of the future of retail payments. Start building stablecoin applications or run a validator on ETHPAR today.

Join the Network